If you’re worried about a coming recession, you’re not alone. Over the past couple of years, there’s been a lot of recession talk. And many people worry, if we do have one, it would cause the unemployment rate to skyrocket. Some even fear that a spike in unemployment would lead to a rash of foreclosures similar to what happened 15 years ago.

However, the latest Economic Forecasting Survey from the Wall Street Journal (WSJ) reveals that, for the first time in over a year, less than half (48%) of economists believe a recession will actually occur within the next year:

“Economists are turning optimistic on the U.S. economy . . . economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.”

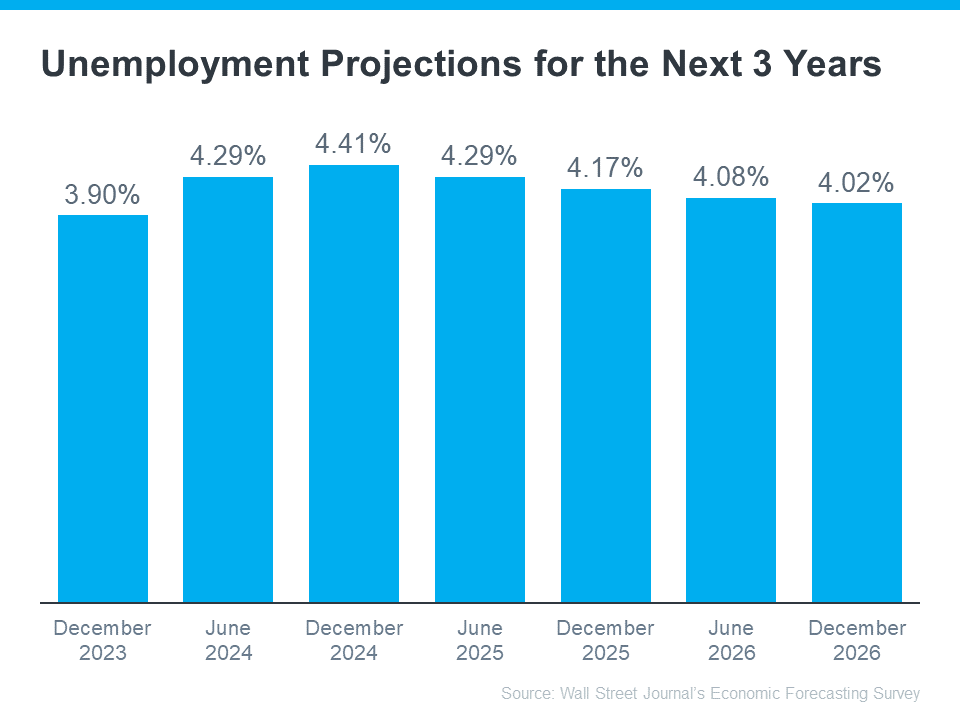

If over half of the experts no longer expect a recession within the next year, you might naturally think those same experts also don’t expect the unemployment rate to jump way up – and you’d be right. The graph below uses data from that same WSJ survey to show exactly what the economists project for the unemployment rate over the next three years (see graph below):

If those expert projections are correct, more people will lose their jobs in the upcoming year. And job losses of any kind are devastating for those people and their loved ones.

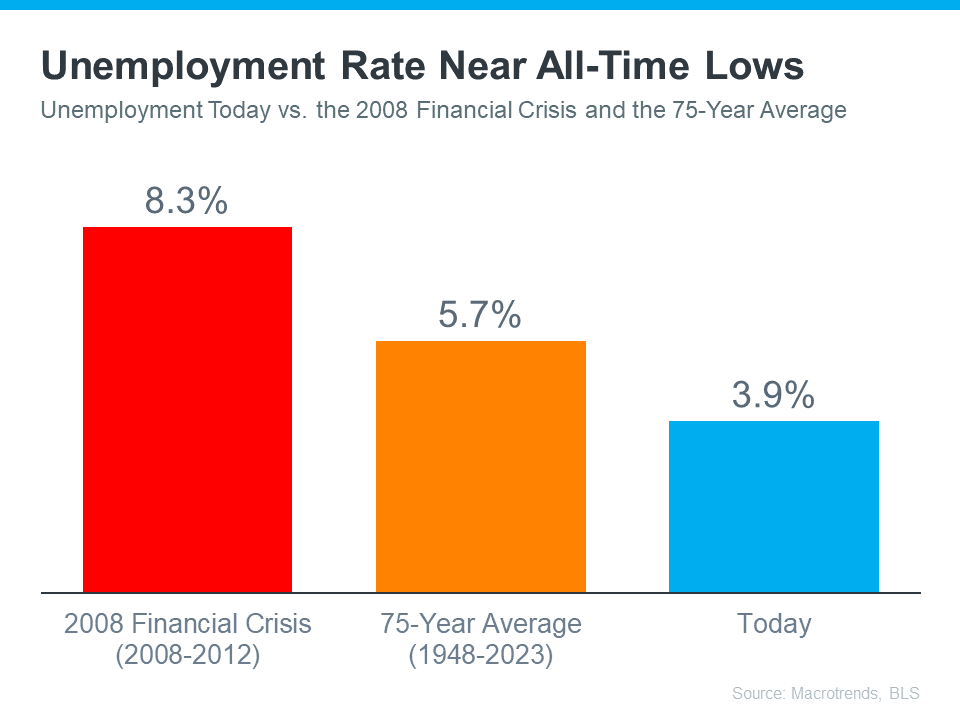

However, the question here is: will there be enough job losses to cause a wave of foreclosures that will crash the housing market? Based on historical context from Macrotrends and the Bureau of Labor Statistics(BLS), the answer is no. That’s because the unemployment rate is currently near all-time lows (see graph below):

As the orange bar in the graph shows, the average unemployment rate dating back to 1948 is 5.7%. The red bar shows, the last time the housing market crashed, in the immediate aftermath of the 2008 financial crisis, the average unemployment rate was up to 8.3%. Both of those bars are much higher than the unemployment rate today (shown in the blue bar).

Moving forward, projections show the unemployment rate is likely to stay beneath the 75-year average. And that means we won’t see a wave of foreclosures that would severely impact the housing market.

Bottom Line

Most economists no longer expect a recession to occur in the next 12 months. That’s why they also don’t expect a dramatic rise in the unemployment rate that would lead to a rash of foreclosures and another housing market crash. If you have questions about unemployment and its impact on the housing market, connect with a real estate professional.

The data relating to real estate for sale on this website comes in part from the Broker Reciprocity program of the MMLS, Inc. Real estate listings other than provided by this office are marked with the Broker Reciprocity IDX logo and the view of information about them includes the name of the listing broker. Information is being provided for consumers' personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing.

The data relating to real estate for sale on this website comes in part from the Broker Reciprocity program of the MMLS, Inc. Real estate listings other than provided by this office are marked with the Broker Reciprocity IDX logo and the view of information about them includes the name of the listing broker. Information is being provided for consumers' personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing.